|

|

|

|

|

|

I'm going to need those TPS reports ASAP

By Morgan Christen

CFA, CFP, CDFA, MBA, CEO and CIO

Welcome,

In the classic film, "Office Space," the main character Peter is bored and tired of the cubicle life. So bored, in fact, he decides he is not going to go to work anymore.

|

|

|

|

|

Americans are bored; a recent survey says that adults experience 131 days of boredom per year. What is more, Americans also are sitting on a pile of cash. 2020 saw lower expenses, we paid down debt and saved the stimulus checks. The Fed plied the markets with the beautiful elixir of liquidity.

|

|

|

|

|

Americans have been alleviating their boredom by buying all forms of crypto and hot meme stocks. Watch for the headlines, "your neighbors are getting rich, are you?" This has caused some assets to reach silly levels. As Robert Hunter, the lyricist for the Grateful Dead once warned, "when life looks like Easy Street, there is danger at your door."

|

|

|

|

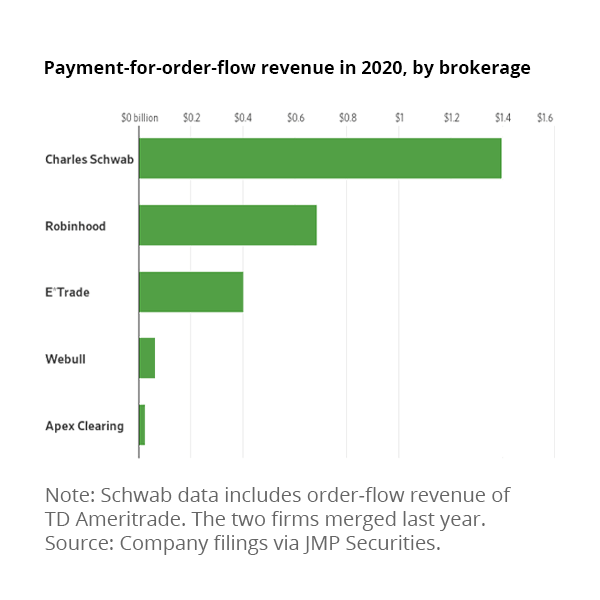

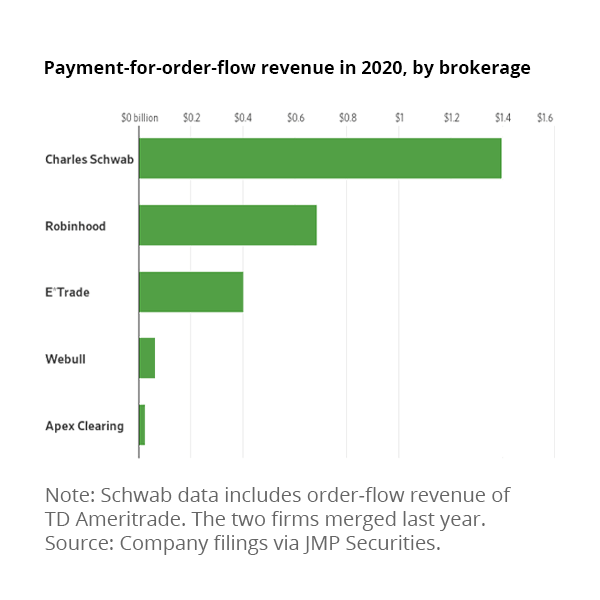

With zero-commission and easy to use platforms, investors piled into stocks and options at record levels. Major brokerage firms could not be happier with all the trading. Even with zero-commission trades, they are doing quite well, thank you.

High-speed trading firms pay brokerage houses for the right to execute orders from all the retail investors. The more we trade, the more they make.

|

|

|

|

|

|

|

|

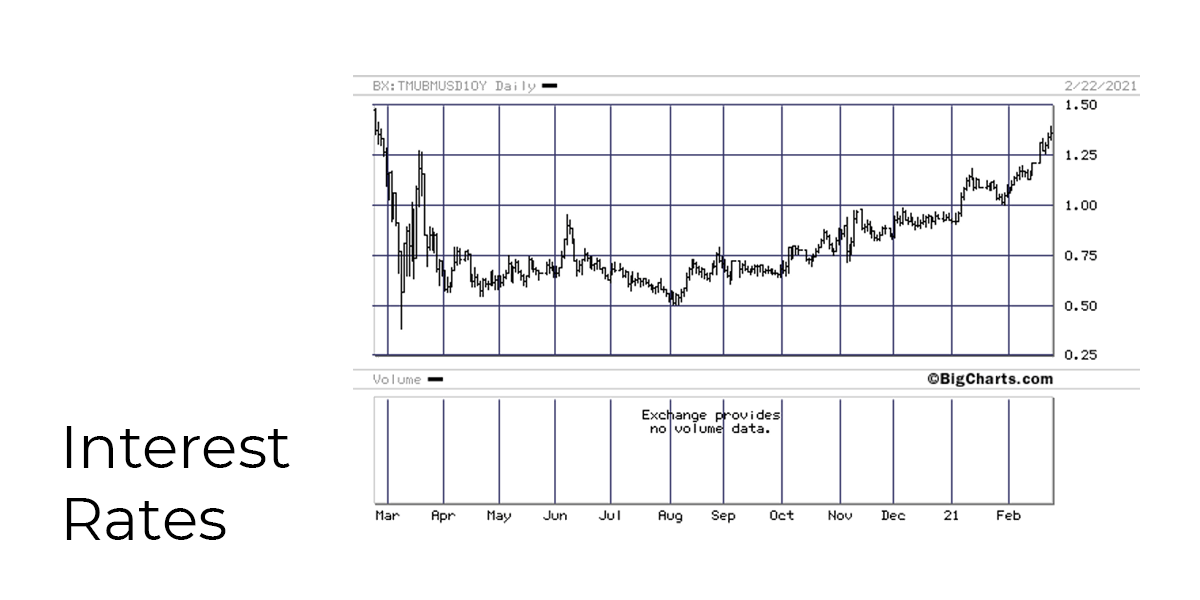

Interest rates have been moving from the lows of 2020, although they are not back to levels seen last March. Stimulus, comments from Janet Yellen and the Fed, are all fueling speculation that inflation is on the rise. Makes sense. Rising interest rates could put a damper on equities but forecasted earnings should outweigh the rate increase.

Interest rates moving up can be seen as a positive. Over the last several years, investors have been buying bonds and selling stocks. When bonds are bought their prices go up and the yield goes down.

|

Are investors getting more bullish about the economic rebound? Not all stimulus money was spent on stocks, as retail sales jumped 5.3% in January.

Other good news, as stated earlier we are sitting on a tremendous amount of savings, to the tune of an extra $1.5 trillion. Construction, delivery and warehousing jobs have surpassed pre-pandemic levels and the retail and restaurant space has started to recover.

Interest rates are submitting a TPS report on the economy. Things are looking better. Mmmm, OK?

|

|

|

|

Conclusion

Just like in Las Vegas, the house always wins. Speculators buying into the frenzy will continue to enrich the brokerage houses at their own peril. You never want to be the last one at the party, always better to make a classy early exit.

"Remember next Friday is Hawaiian shirt day. So, you know, if you want to, go ahead and wear a Hawaiian shirt and jeans."

|

|

|

|

|

Once America puts on their Hawaiian shirts and start to travel and spend, we may see a few things. We anticipate a surge in travel and spending, which is great for the economy. We are bored and we want to be with friends, family and anywhere but home.

It should be interesting to see where crypto and meme stocks go once interest is turned elsewhere. Is there a parallel with money saved and levels of boredom? Once boredom goes away, will savings follow?

Bored or not, we are here for you. Contact us today and explore what's possible.

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2021 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. 10-year Treasury chart courtesy of bigcharts.com. Quotes are from Office Space the movie.

|

|