|

|

|

|

|

|

Stability Breeds Instability

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

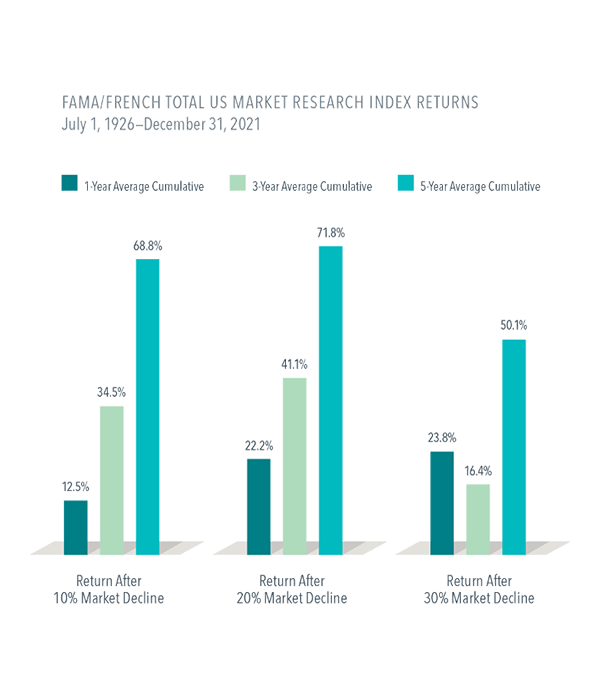

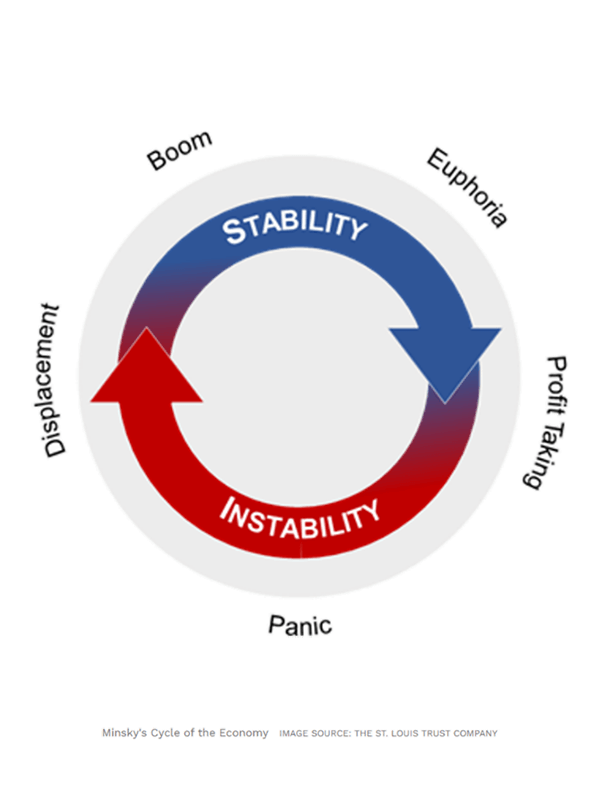

Hyman Minsky, an economist, proposed a theory he labeled the "financial instability hypothesis," which states that stable economies create their own destruction due to stability. The safeness of stability will entice people to take risks, and those risks create financial instability that can lead to panics.

|

|

|

|

|

Feels a bit like today. After many years of zero-percent interest rates, the economy seemed stable. The market values a company by taking the future earnings and bringing them back to the present based on an interest rate. If you are using the risk-free rate (Treasury securities), at zero percent the value could be unlimited.

As a result, investors piled into risky assets. Why earn zero in the bank when you can buy technology companies that are nowhere near earning a dime, or how about an NFT or Crypto coins?

|

|

|

|

Stability creates instability. I wrote about sports arenas being named after Crypto firms at the beginning of the year, and how that was reminiscent of the technology crash. Remember CMGI field? Didn't think so. It happened again; companies flush with cash from investors piling in splurged on naming rights just before the drop.

|

|

|

|

The markets' current boogie man is both inflation and the tool being used to tamp it down, which market participants fear could lead to a recession. Is this economy bad or does it just feel yucky? Some famous people have chimed in, Elon Musk in a recent talk with Tesla executives, told them he has a "super bad feeling" about the economy. Jamie Dimon the CEO of JP Morgan Chase warned of an economic "hurricane."

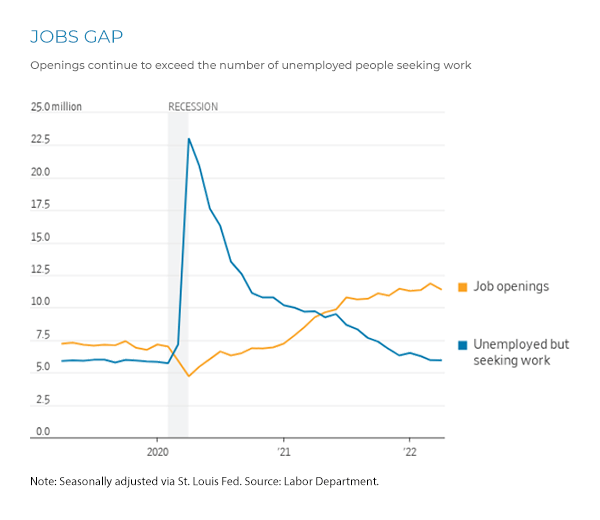

On the positive side, former Goldman Sachs CEO Lloyd Blankfein said on Twitter, "dial back the negativity on the economic outlook. If I'm managing a big company of course I'm prepping for the worst. But the economy is in a strong place, with more jobs than takers, and is adjusting to higher rates."

|

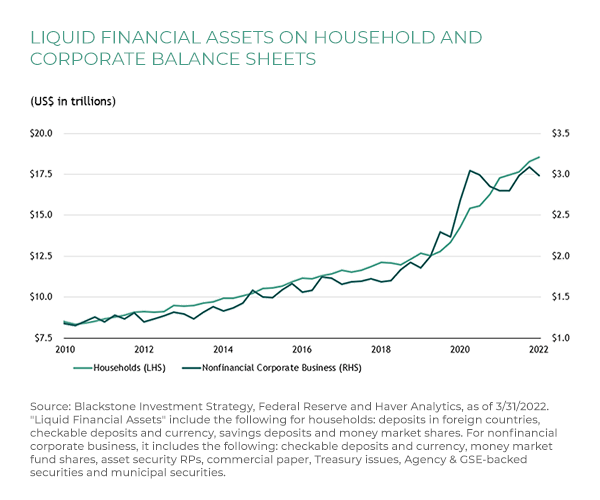

Much like stability in Minsky's hypothesis, recessions work the same way. Too much optimism creates risk as consumers and business take on too much debt, the debt creates a lack of "consuming" which slows the economy and creates instability; and then you have a recession. But unlike other recessions, the current labor market is in great shape, and household as well as corporate balance sheets are strong.

We do have the Fed fighting inflation through interest rates, potentially forcing the economy to slow down. Inflation is the top priority for the Fed as most Americans find it to be of major concern. Heck, even the rapper 50 Cent changed his name to 85 Cent to adjust for inflation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stocks

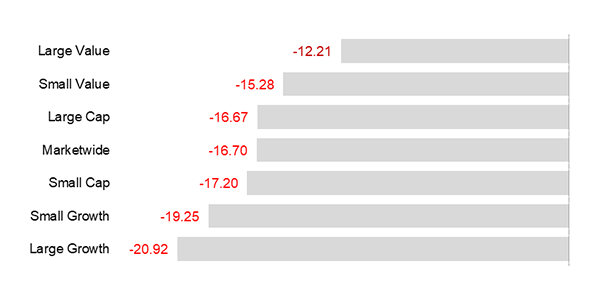

So far, the year has been on quite a roll. For the first time in a while, value stocks outperformed their growth peers.

Stocks that benefited from the zero-interest rate world tend to fall in the growth column.

|

The S&P 500 has dropped over 20%, and lost more than $9T in market capitalization, while the Nasdaq is off over 30% and the Dow Jones is off over 15%. Add to that, the 10-year Treasury yield has climbed from 1.5% to just around 3%.

The stars of the zero percent world have fared far worse: Bitcoin is off over 50%, Netflix off over 70%, Meta off over 50% and Coinbase over 80%.

|

|

|

|

Bonds

Bonds

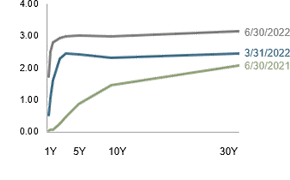

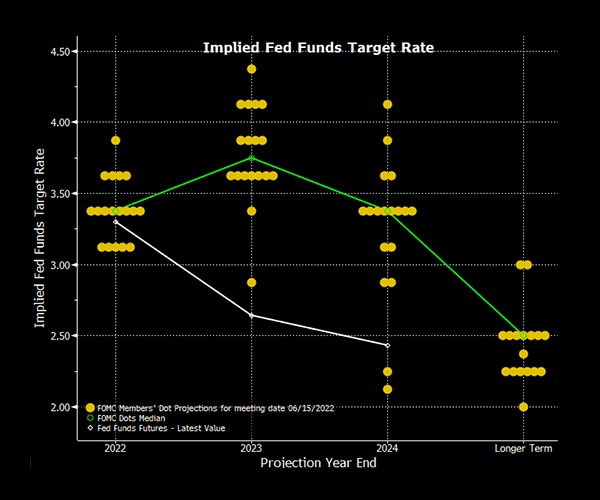

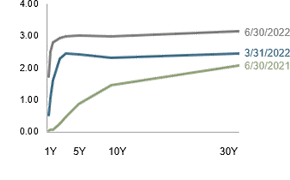

As the chart shows, there was a dramatic move in rates over the last quarter especially on the short end of the curve. 1-month Treasury Bills increased 111 basis points (bps) to 1.28%, the 1-Year Treasury Bill increased 117 bps to 2.80%.

The increase in the rates negatively impacted the value of bonds/bond funds, but over time with the higher yielding bonds now being purchased in funds, a better second half should be expected.

|

|

|

|

|

|

Interest rates on the short end move with the Fed, while rates on the long end move with the inflation rate.

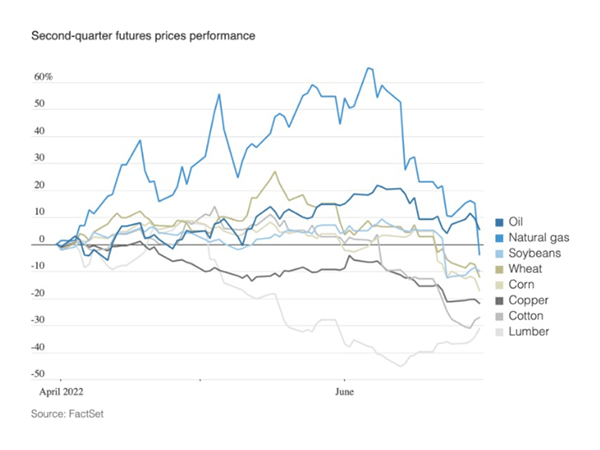

One bright spot on the inflation front is that commodities have been on a downhill slide.

|

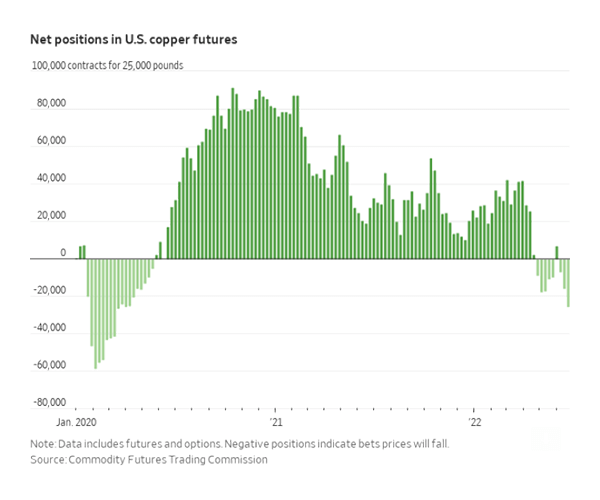

Two takeaways from the commodity slide: first, inflation could be on its way down. Second: copper, which is a gauge of economic activity, is down significantly, suggesting a slowdown in the economic output. A recession equals two quarters of an economic slowdown.

|

|

|

|

|

|

Now What?

There was a great article written by Derek Thompson in the Atlantic, entitled "The End of the Millennial Lifestyle Subsidy." Basically, he says that we had a good run with cheap rides with Uber and Lyft, and cheap food delivery with DoorDash, Postmates etc.

|

But it has come to an end as the zero-interest rate world allowed those companies to collectively lose billions of dollars. Times are changing and we will all adjust. The zero-interest rate world was not sustainable and it created the inflation we feel today. By the way, we have had inflation for a while... look at all the inflated assets around us.

|

|

|

|

|

|

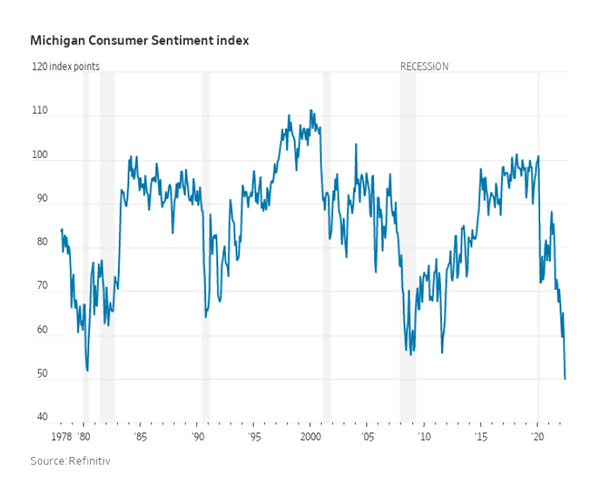

Consumers are scared, as reflected in the Michigan Consumer Sentiment Index. Looking at that chart, consumers are more depressed than they were in the 50s. Seems a bit extreme if you ask me.

Consumers are scared, as reflected in the Michigan Consumer Sentiment Index. Looking at that chart, consumers are more depressed than they were in the 50s. Seems a bit extreme if you ask me.

We are not in line for gas and suffering double digit inflation. We are not at the brink of a complete breakdown and failure of the global banking system like we had in 2007. While there is a war in the Ukraine, the U.S. is not involved in combat like we were in the past decades.

|

|

|

|

|

|

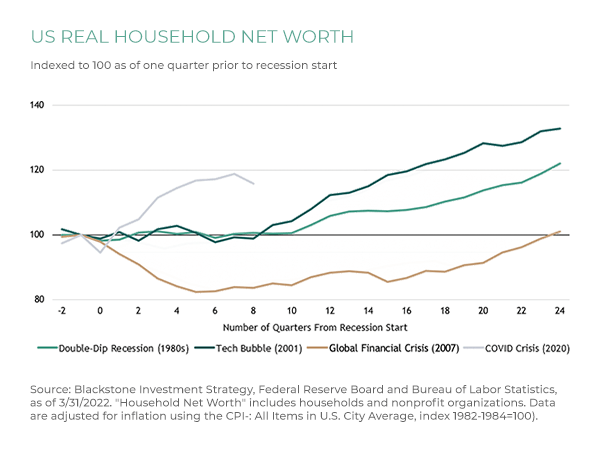

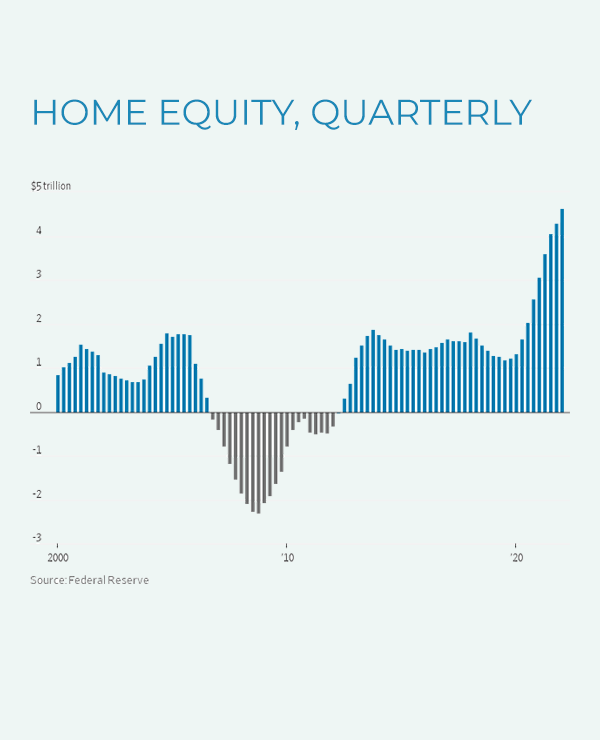

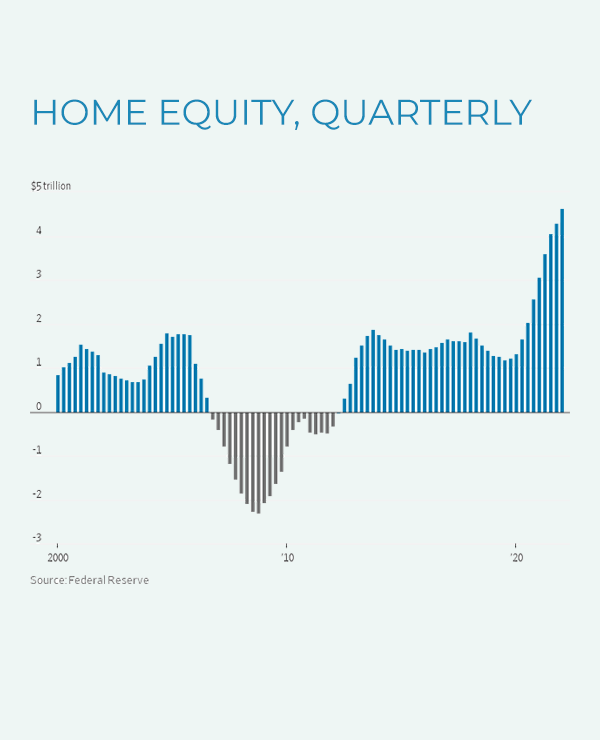

The majority of Americans' largest asset is their home, rather than stocks and bonds. As the chart shows for US Real Household Net Worth, when real estate bursts, it takes a while to build back net worth. Meaning, sentiment for the economy stays low for a while.

This time real estate may move down a bit, but it will become more rational. We do not anticipate major price reductions in homes, at least there will be some inventory to choose from. Home equity is close to $5T versus $1T in 2020. Better loans were written and homeowners that get in trouble can sell and walk away with something.

|

|

|

|

|

|

|

|

|

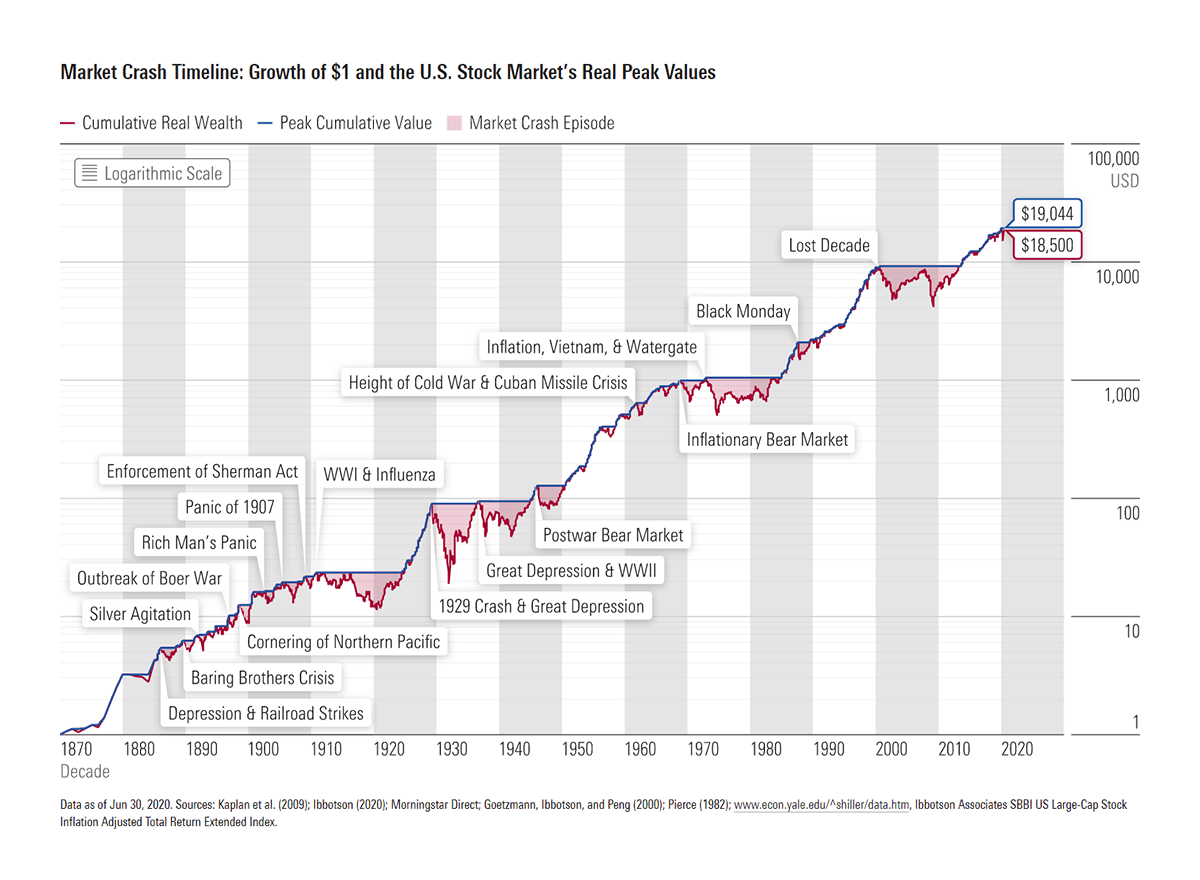

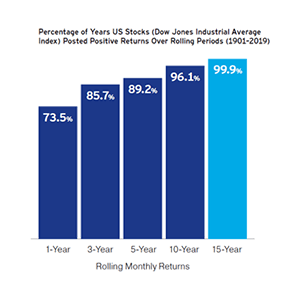

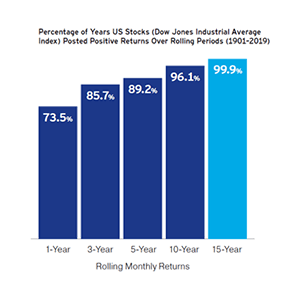

Unfortunately, market pullbacks happen, but generally that is healthy. We will create a new base to move forward from. I am not a gambler, but I would take the stock market over any game in Vegas.

|

|

|

|

|

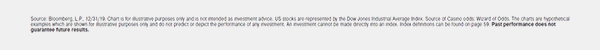

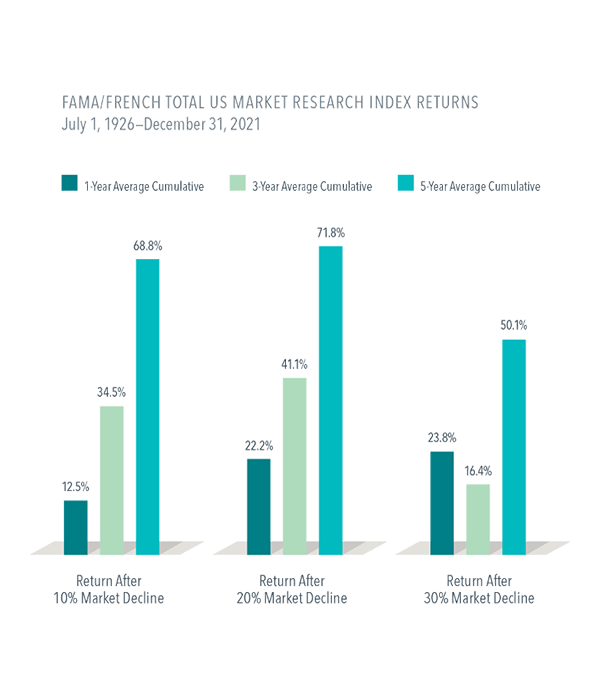

As the chart shows, over 5-year periods, the market has been positive almost 90% of the time.

|

|

|

|

|

|

|

|

|

As the Fama and French chart shows, after big declines like we have been experiencing, the market moves forward over the next couple of years. As stated earlier, there are almost two jobs for every one person looking... pretty health job market.

Interest rates are higher, and that is good for bond buyers. Frankly, anyone above a certain age has experienced much higher mortgage rates. 5% doesn't look that bad, and they should ease over the next couple of years... even the Fed agrees when you look at the dot plot above.

|

|

|

|

|

In Closing

There is an old Chinese proverb that states, "the best time to plant a tree was 20 years ago. The second-best time is now." Stay on course, there seems to be a bit of an overreaction in the bond and stock markets. Bonds should settle and have a better second half.

One of the worst decisions would be to abandon your long-term goals as you experience short-term pain. We thank you for your continued support and look forward to speaking with you soon.

|

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2022 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follows: Marketwide (Russell 3000 Index), Large Cap (Russell 1000 Index), Large Value (Russell 1000 Value Index), Large Growth (Russell 1000 Growth Index), Small Cap (Russell 2000 Index), Small Value (Russell 2000 Value Index), and Small Growth (Russell 2000 Growth Index). Dow Jones US Select REIT Index used as proxy for the US REIT market. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2022, all rights reserved. Stock return Charts from Dimensional Fund Advisors. Inflation is typically defined as the change in the non-seasonally adjusted, all-items Consumer Price Index (CPI) for all urban consumers. CPI data are available from the US Bureau of Labor Statistics. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice.

|

|

Bonds

Bonds

Consumers are scared, as reflected in the Michigan Consumer Sentiment Index. Looking at that chart, consumers are more depressed than they were in the 50s. Seems a bit extreme if you ask me.

Consumers are scared, as reflected in the Michigan Consumer Sentiment Index. Looking at that chart, consumers are more depressed than they were in the 50s. Seems a bit extreme if you ask me.