|

|

|

|

|

|

Fear or Phobia

By Morgan Christen

CFA, CFP, CDFA, CEO and CIO

Welcome,

After 25 years as an ICU nurse, my wife hung up her N95 and went to work at a blood donation center. Long days on her feet and patients mistaking the hospital for Burger King as they demanded to "have it their way" led to the move.

Being the supportive husband, I agreed to be one of her first patients to donate.

|

|

|

|

|

The problem for me was my lifelong fear of needles. Trypanophobia is the "extreme" fear of needles, more like a phobia. Mine was more a fear than a phobia. WebMD says the fear is something every person deals with.

It is natural and normal to feel anxious about things, especially involving large needles coming into your skin. A phobia is a disorder that presents more extreme symptoms and feelings.

The pain from the needles was quite minimal compared to other types of pain I have endured. The anticipation though was intense and far worse than the pain.

|

|

|

|

|

|

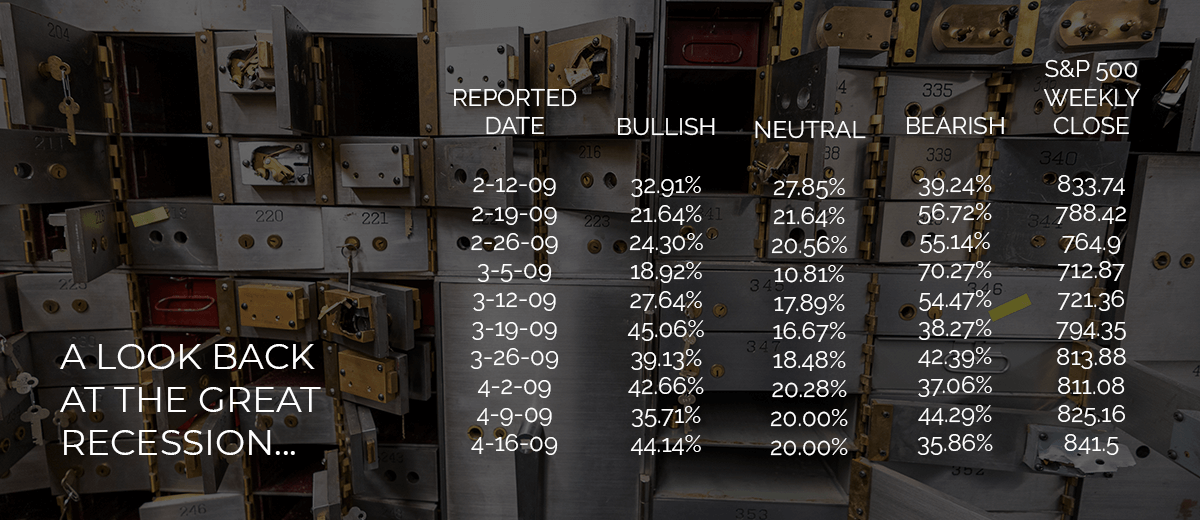

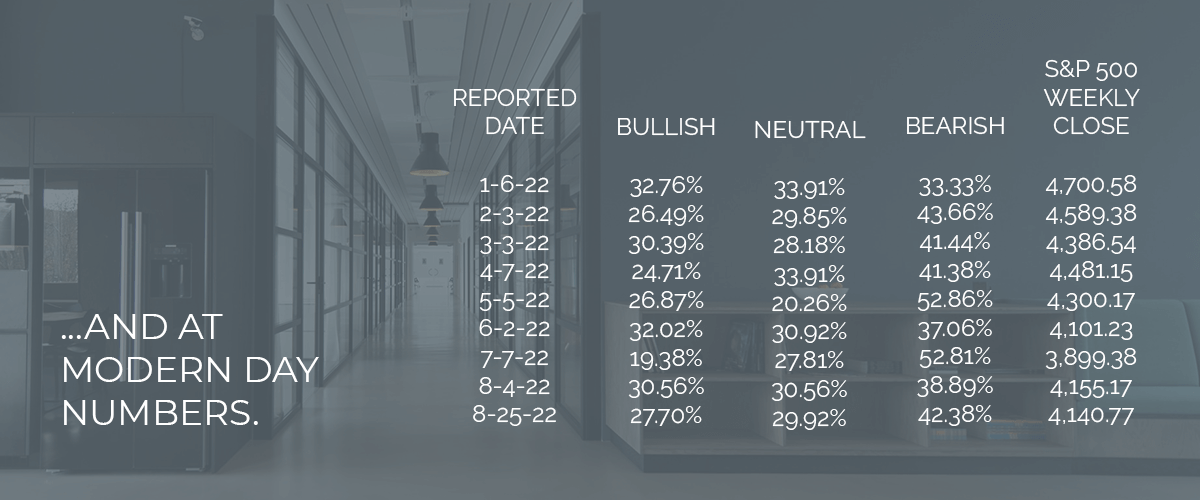

The American Association of Individual Investors (AAII) puts out a weekly sentiment survey. The fear of anticipation has a profound effect on investors. Sentiment turns exceedingly bearish on the way down and bullish once it moves up. You can see parallels from the Great Recession and current situation in the charts.

|

|

|

|

|

Back in 2009, the big fear was our financial system would implode. Some banks and brokerages did fail, but alas the world didn't come to an end. Currently, the fear is the hawkish Fed raising rates, the Russian invasion of Ukraine and the potential for China to invade Taiwan.

|

Keep that needle away, the anticipation is killing me.

The fact is the end of the world only happens once, and this is not the time. We worry, anticipate, and fear, only to realize later it was unwarranted.

|

|

|

|

|

|

|

|

|

|

|

|

|

Will the Fed continue to raise rates? Bet on it. Minneapolis Fed President Neel Kashkari was quoted as saying he was "happy" to see how investors responded to Powell's Jackson Hole talk because "people now understand the seriousness of our commitment to getting inflation back down to 2%."

|

The Fed is serious, and they made it known. They started late but are now in the game and it will take a long time to get us back to 2%. Inflation has potentially peaked, but that is a far cry from the 2% level. This could (and probably will) push us into recession. Apply the tourniquet and face the fear.

|

|

|

|

Anticipation is tough, but the man who is quoted as saying "be greedy when others are fearful" is loading up on stocks. Warren Buffett invested almost $45 billion in stocks in the first half of the year.

From the chart above, the markets bottomed in 2009 during the great recession. From that base, the Nasdaq went on a tear, up over 1,100% from that point.

Fearful or Greedy?

|

|

|

|

|

There are reasons to be concerned, but what we anticipate and what is reality are totally different. I can't say that I love giving blood, I do get anxious, but I am there every eight weeks. By the way, the blood banks need your help - give blood. It is a (somewhat) easy way to help your fellow man and possibly distract you from the news.

Thank you for your continued support. We look forward to speaking with you soon.

|

|

|

|

|

Have You Taken

The SpinnCycle™?

A quick reality check for your portfolio

Enter the SpinnCycle and find your SpinnScore™

|

|

|

|

|

|

Spinnaker Mobile App now Available for IOS and Android

|

|

|

|

|

Spinnaker Investment Group is a boutique, family-owned investment advisory firm that helps each investor design, implement and run a portfolio. We work directly with each client to help them realize their financial independence.

© 2022 Spinnaker Investment Group. All Rights Reserved.

Disclosures

|

GET IN TOUCH

949.396.6700

info@spinninvest.com

spinninvest.com

4100 MacArthur Blvd., Ste 120

Newport Beach, CA 92660

|

|

|

|

|

DISCLOSURES: Past performance is not a guarantee of future results. Indices are not available for direct investment. Stock is the capital raised by a corporation through the issue of shares entitling holders to an ownership interest of the corporation. Treasury securities are negotiable debt issued by the United States Department of the Treasury. They are backed by the government's full faith and credit and are exempt from state and local taxes. The indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results, and there is always the risk that an investor may lose money. Diversification neither assures a profit nor guarantees against loss in a declining market. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the securities mentioned. The information contained herein, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable. Opinions expressed herein are subject to change without notice. Chart data courtesy of the American Association of Individual Investors.

|

|